2018 Crypto Bear Market Repeating? Recap the Cause of the Dump This Time

.jpg)

Is Crypto In A Bear Market Now? Recently, the crypto market has not been doing well. All crypto is falling like crazy. At least 70% of his ATH. Thanks to the drop in crypto prices, the crypto market cap is currently under $1 Trillion.

Bitcoin are down.

Ethereum is down.

Your meme coin is down.

deja vu.

Very similar to the 2018–2019 bear market. All cryptos are depreciated. $ETH is down by 90%. The trash ICO token is dead. There's no news. Only a few are left like $AAVE and $LINK.

Then, what is the cause of the market crash this time? What's the bad sentiment going on lately?

There are some bad catalysts that make the crypto market suffer massive drawbacks, let's discuss them one by one.

$46B Collapse

All of this was started by UST — the USD stable coin by Terra — which was de-pegged on May 8, 2022. Initially, the depeg ratio was very slim for an algorithmic stablecoin, 0.98. As it turned out, the 0.02 point drop was enough to make people panic.

Many people who withdrew UST from Anchor, exchanged UST for other stablecoins, left the Terra ecosystem by selling LUNA. These three actions have crazy effects. As a result, the price of UST fell.

Because UST is closely related to LUNA, when the price of UST falls, the supply of UST decreases, the supply of LUNA increases, the price of LUNA decreases.

The above was done to return the UST price to $1. Just because there are more people selling LUNA than buyers and there are too many people exchanging UST to USDT/C, this cannot be achieved. This incident resulted in the above process being carried out continuously until the LUNA price was "0".

This case is called a death spiral. The analogy is the Bank Run which occurred in 1993 and 2008.

Now the Terra Classic is $0.00006481 and the UST Classic is $0.008702 with supplies of 6.5 billion and 10.25 billion, respectively.

Salute to those who have survived since this incident and still believe in crypto is the future.

I'm with you guys. Guys also Rekt on Terra.

For friends who have just joined crypto, I hope this doesn't happen.

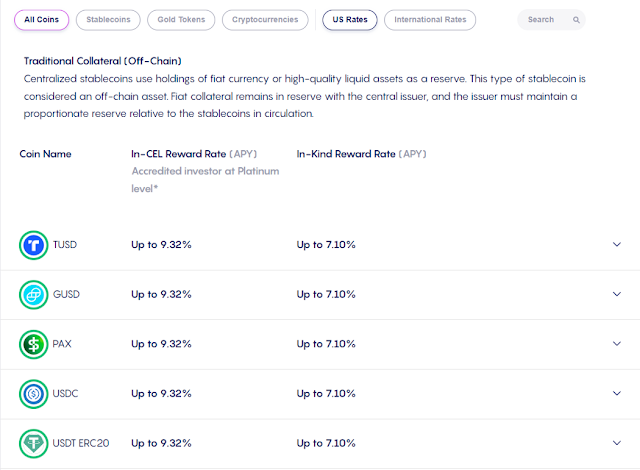

Celsius *almost* default

Celsius is one of the centralized crypto lending companies. They offer lending products with an APR that is quite tempting up to 19% per year for retail investors.

When numbers go up, paying high interest to users is not a bad strategy. Currently Celsius has a total user range of 1.7 million. Quite a lot. But what about during a bear market?

The price of the token dropped to the abyss.

TVL Dropped.

Fewer DeFi Borrowers.

These 3 things are enough to make a company as big as Celsius unable to pay investors' money. It was so difficult to pay the incoming deposit, they turned off the asset withdrawal feature on the platform

The reason they can't pay their depositors is for 2 reasons

The assets they hold are illiquid.

The majority of the assets that Celsius has are in the form of stETH, staked ETH from Lido Finance. As we know that stETH has a guaranteed 1:1 exchange to ETH, but after The Merge is over.

As long as the Ethereum Foundation has not completed the migration of Ethereum from PoW to PoS, the liquidity of stETH is subject to market prices. At this moment, the exchange rate of ETH <> stETH is not 1:1 but 0.94 ETH per 1 stETH.

Some Celsius investments were affected by the hack.

In addition to entering the money Aave, Compound et al. Celsius also invested its investors' money into badgerDAO, a DeFi project. Unfortunately, this project was hacked for $150 million and Celsius was one of the victims. Given that Celsius lost about $50 million from the incident.

https://cryptopotato.com/celsius-network-reportedly-lost-50-million-in-the-120-million-badgerdao-hack/

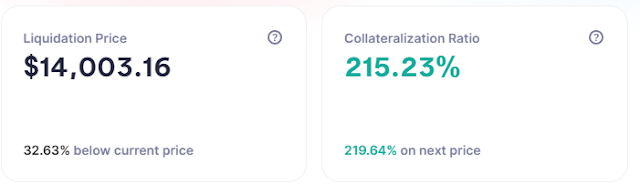

Collateral that is getting closer to the liquidation level.

It turned out that Celsius put his investors' funds into several DeFi projects such as Aave, Compound and Maker. The funds they put are now at risk of being liquidated and currently they are trying to reduce that risk by way of top-up collateral and paying off outstanding debt.

As of 06/15/2022, the Liquidation Celsius level was at $14k. Previously it was at $22k.

Three Arrows Capital is also the default (Rumor)

Similar to the Celsius case, Three Arrows Capital who is familiarly called 3AC also experienced the same problem. It's just sad that I haven't got enough info and data to say more.

So far rumors about one of the biggest crypto hedge funds have spread everywhere. From 3AC's on-chain data, tens of thousands of stETH have been dumped. Remember that stETH is not 1:1 ETH? Yes, it means he is selling at a loss, to meet the redemption needs of their investors.

Moreover, on the FTX leaderboard, they are among the top 3 traders based on PnL. I'm not sure if this leaderboard is by profit or by losses. The assumption is that this cave is by Loses because their recent rumors are not good.

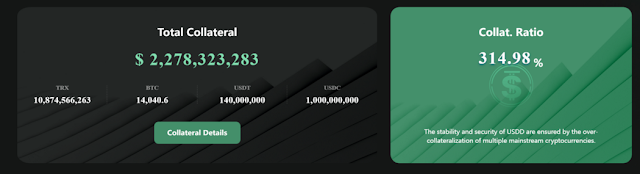

USDD *de-peg*

Justin Sun's Decentralized Stablecoin, which is closely correlated with TRX, has been de-pegged. Currently the price is 1 USDD =/ $1 instead of $0.97. Inspired by the success of LUNA/UST which was once worth $46B and is now ashes, will USDD/TRX suffer the same fate?

If I check on the USDD website, the Tron Dao Reserve is in charge of maintaining USDD stability, much like Luna Foundation Guard has assets of $1.4 B (not including TRX).

With a USDD supply of $723 million. With this data, it can be seen that the collateralized USDD is 200%. In short, in my opinion USDD can be said to be safe for data speaking.

But, this is Justin Sun. I'm not a big fan of him.

The macroeconomy is not doing well.

The state of the global economy is also not good. Inflation in the United States reached 8% in the first quarter of 2022. This is a very large number. With high inflation rates, the Fed raises its benchmark interest rate which makes the cost of borrowing money more expensive and deposit rates more attractive than volatile assets such as crypto.

On 15–16 June US time, the Fed will hold the Federal Open Market Committee Meeting, or FOMC Meeting. This meeting will usually produce an action plan for the Fed. If the US central bank raises interest rates again, then it is very likely that people will cash out of crypto and prefer deposits or mutual funds because they are safe and the interest is also decent.

In addition to the Fed, many technology and crypto companies are making layoffs. Coinbase fired its employees. Crypto.com does the same. With layoffs like this, people will prefer to save just in case rather than buy crypto.

The good times are no more. Bear market will stay. But one thing for sure bear market is a gift. This is the wealth generation that you are looking for.

0 Response to "2018 Crypto Bear Market Repeating? Recap the Cause of the Dump This Time"

Post a Comment